Value Proposition for Accredited Investors

It can become extremely challenging to keep up with the fast pace of change in a constantly evolving world, amid rising inflation and economic uncertainties.

In recent years, the extremely low returns on actively managed Private Equity, hedge funds and bonds, laced with all kinds of fees that eat into investment returns, have fuelled a rising demand for safe and predictable investment yields.

The ongoing complexities of capital and financial markets make it imperative for Pension Funds, Sovereign Wealth Funds, Insurance Companies, Endowments, Banks, Foundations and Family Offices to look towards robust investment strategies that are sustainable and resilient to future shocks.

At GDP Capital, we appreciate the need for safe and sustainable growth and stability. With our deep expertise, we strive to deliver attractive returns to our investors while minimizing risks.

GDP Capital leverages on private capital to provide long-term investments to private and public corporations in Asian countries and states to achieve growth and stability. Investors have peace of mind knowing that their investment capital is safe, and returns are secured.

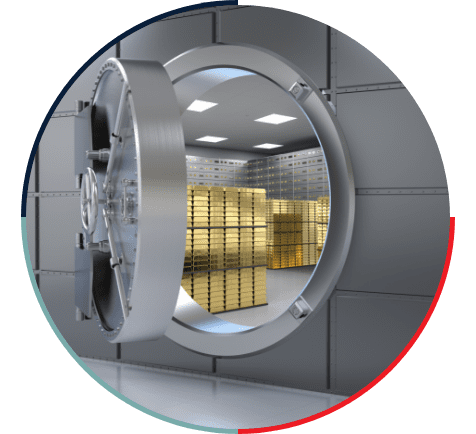

Safety of Capital

Our investments are structured to ensure safe and healthy returns for your capital.

Investors will enjoy tax advantages in a fund registered and managed out of a reputable and internationally recognized offshore financial center, British Virgin Islands (BVI).

Accredited investors may request for the Private Offering Memorandum and related documents outlining the terms and conditions for investment and to become an investor. Strictly for accredited investors only.

Investment Strategy

At GDP Capital, our investment strategy focuses on large private and public corporations that offer attractive risk-adjusted returns. We employ a rigorous approach to risk management and value creation to generate high returns in various sectors.

Value Creation

Our value creation strategies focus on driving operational improvements, strategic partnerships, and growth opportunities. We work closely with our portfolio companies to identify areas for improvement and leverage our deep expertise in the private and public sector to unlock value.

Risk Management

We employ a range of risk management strategies, including diversification and rigorous due diligence, to minimize the risk of capital loss. Our strict investment criteria ensure that we only invest in businesses that meet our risk profile and offer attractive returns.

Investment Process

Our investment process is based on a step-by-step approach that includes sourcing, screening, due diligence, and execution. We have a rigorous screening process that allows us to identify attractive investment opportunities in the public sector. We then conduct thorough due diligence to ensure that the investment meets our risk profile and offers attractive returns. Once we have identified an investment opportunity, we work closely with our portfolio companies to execute on our value creation strategies.

Portfolio

Our investments will include a range of large private and public corporations across various sectors, including infrastructure, healthcare, and energy. Our portfolio companies will benefit from our operational expertise and strategic guidance, which helps them achieve their growth objectives.